The following is the adjusted trial balance of Sierra Company, a critical step in the accounting cycle that provides a clear and concise overview of the company’s financial position at a specific point in time. This document plays a pivotal role in the preparation of the balance sheet and income statement, two essential financial statements that offer valuable insights into the company’s financial performance and health.

This comprehensive guide will delve into the purpose, components, and significance of the adjusted trial balance, empowering readers with a thorough understanding of its role in the accounting process.

Adjusted Trial Balance

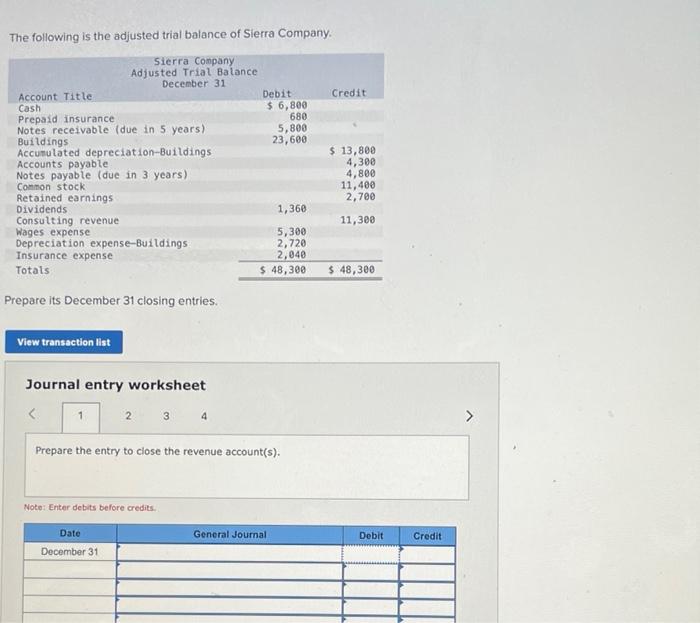

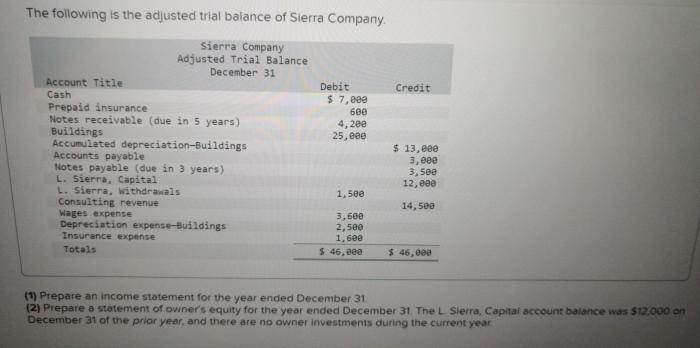

An adjusted trial balance is a financial statement that lists all of a company’s accounts and their balances after all adjustments have been made. The purpose of an adjusted trial balance is to provide a complete and accurate picture of a company’s financial position at a specific point in time.

The steps involved in preparing an adjusted trial balance are as follows:

- Start with the unadjusted trial balance.

- Make any necessary adjustments to the accounts.

- Recalculate the balances of all accounts.

- Prepare the adjusted trial balance.

The following is an example of an adjusted trial balance:

| Account | Balance |

|---|---|

| Cash | $10,000 |

| Accounts Receivable | $20,000 |

| Inventory | $30,000 |

| Prepaid Insurance | $4,000 |

| Land | $50,000 |

| Buildings | $100,000 |

Accumulated Depreciation

|

$20,000 |

| Accounts Payable | $15,000 |

| Notes Payable | $25,000 |

| Common Stock | $50,000 |

| Retained Earnings | $30,000 |

Accounts Included in Adjusted Trial Balance

The following types of accounts are typically included in an adjusted trial balance:

- Asset accounts

- Liability accounts

- Equity accounts

- Revenue accounts

- Expense accounts

Asset accounts represent the resources that a company owns or controls. Liability accounts represent the obligations that a company owes to others. Equity accounts represent the ownership interest in a company. Revenue accounts represent the income that a company has earned.

Expense accounts represent the costs that a company has incurred.

The following are examples of each type of account:

- Asset accounts:Cash, Accounts Receivable, Inventory, Prepaid Insurance, Land, Buildings

- Liability accounts:Accounts Payable, Notes Payable

- Equity accounts:Common Stock, Retained Earnings

- Revenue accounts:Sales Revenue, Service Revenue

- Expense accounts:Salaries Expense, Rent Expense, Utilities Expense

Adjustments Reflected in Adjusted Trial Balance

The following types of adjustments can be reflected in an adjusted trial balance:

- Accruals

- Deferrals

- Estimates

Accruals are expenses that have been incurred but not yet recorded. Deferrals are revenues that have been earned but not yet recorded. Estimates are amounts that are not known with certainty but must be recorded in the financial statements.

The following are examples of each type of adjustment:

- Accruals:Salaries Payable, Interest Payable

- Deferrals:Prepaid Rent, Unearned Revenue

- Estimates:Depreciation Expense, Bad Debt Expense

Balance Sheet and Income Statement: The Following Is The Adjusted Trial Balance Of Sierra Company

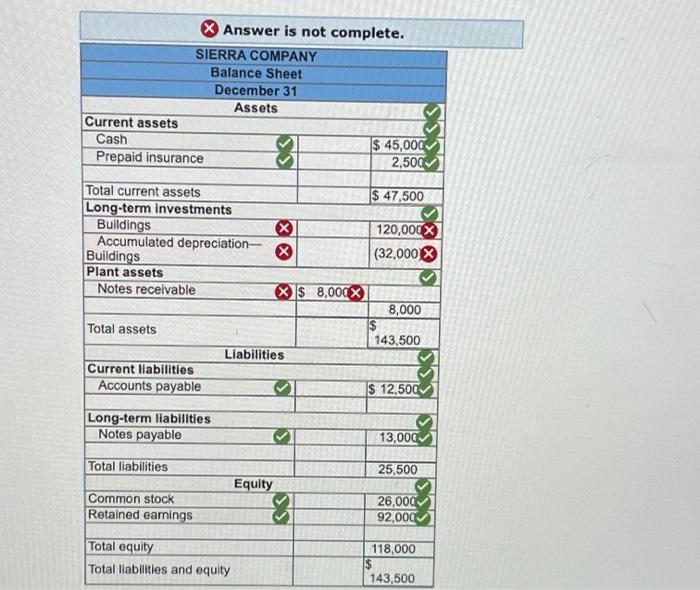

The adjusted trial balance is used to prepare the balance sheet and income statement. The balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. The income statement is a financial statement that shows a company’s revenues and expenses over a period of time.

The following is an example of how the adjusted trial balance is used to prepare the balance sheet:

| Account | Balance |

|---|---|

| Assets | |

| Cash | $10,000 |

| Accounts Receivable | $20,000 |

| Inventory | $30,000 |

| Prepaid Insurance | $4,000 |

| Land | $50,000 |

| Buildings | $100,000 |

Accumulated Depreciation

|

$20,000 |

| Total Assets | $138,000 |

| Liabilities | |

| Accounts Payable | $15,000 |

| Notes Payable | $25,000 |

| Total Liabilities | $40,000 |

| Equity | |

| Common Stock | $50,000 |

| Retained Earnings | $30,000 |

| Total Equity | $80,000 |

The following is an example of how the adjusted trial balance is used to prepare the income statement:

| Account | Balance |

|---|---|

| Revenues | |

| Sales Revenue | $100,000 |

| Service Revenue | $20,000 |

| Total Revenues | $120,000 |

| Expenses | |

| Salaries Expense | $50,000 |

| Rent Expense | $20,000 |

| Utilities Expense | $10,000 |

| Total Expenses | $80,000 |

| Net Income | $40,000 |

Expert Answers

What is the purpose of an adjusted trial balance?

An adjusted trial balance is prepared to ensure that the balances of all accounts are up-to-date and accurate before the preparation of the financial statements.

What are the steps involved in preparing an adjusted trial balance?

The steps involved in preparing an adjusted trial balance include identifying and recording adjusting entries, posting the adjusting entries to the general ledger, and preparing a trial balance.

What are the different types of adjustments that can be reflected in an adjusted trial balance?

The different types of adjustments that can be reflected in an adjusted trial balance include accruals, deferrals, and corrections of errors.